How to Solve Business Problems with Data Science (5-Day Course)

🚀 Bonus #2

Matt's Top 10 Business Concepts

(from his $50,000 MBA Degree)

Today's bonus is an important one! You're learning my top 10 business concepts that every data scientist needs to understand.

Remember: Companies don't care what you know. They only care about results that help the business. And these terms will help you gain credibility (in fact these are the most important concepts from my $50,000 MBA)!

These are key concepts that will help you more effectively work with different parts of the business. Most importantly, they'll help you understand their goals.

Here's what I'm covering with you today:

Part 1: Corporate Finance and Accounting Concepts

Part 2: Marketing Concepts

Part 3: Operations Management Concepts

Part 4: 14 Most Important Domain-Specific Business KPIs

Part 1: Corporate Finance and Accounting Concepts

Business Concept 1:

Return On Investment (ROI)

Return on Investment (ROI) is a key financial metric used to evaluate the efficiency and profitability of an investment, comparing the magnitude and timing of gains from an investment relative to its cost.

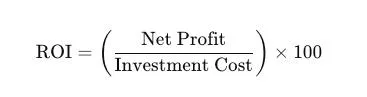

It is a ratio or percentage that measures the return on an investment relative to its cost, providing a simple, quantitative analysis of its profitability. The formula for calculating ROI is:

Here's a breakdown of the formula components:

Net Profit is the earnings from the investment, subtracting the costs associated with making and maintaining the investment.

Investment Cost is the total amount spent to acquire, implement, and maintain the investment.

The result is expressed as a percentage, providing a clear measure of the investment's efficiency in generating profit. For example, an ROI of 150% indicates that the returns are one and a half times the initial cost.

Business Concept 2:

Net Present Value (NPV)

Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or project. It represents the difference between the present value of cash inflows and the present value of cash outflows over a period of time. NPV is a central tool in discounted cash flow (DCF) analysis and is a standard method for using the time value of money to appraise long-term projects.

NPV helps executives, investors and managers to make informed decisions by comparing the value of dollars today to the value of dollars in the future, taking into account risk and opportunity costs.

Here's why NPV is important:

Time Value of Money: NPV accounts for the principle that a dollar today is worth more than a dollar in the future due to its potential earning capacity. This core tenet of finance holds that, provided money can earn interest, any amount of money is worth more the sooner it is received.

Investment Appraisal: NPV provides a method to evaluate whether a project or investment will generate more value than its cost, considering the time value of money. A positive NPV indicates that the projected earnings (in present dollars) exceed the anticipated costs (also in present dollars), making it a financially viable option.

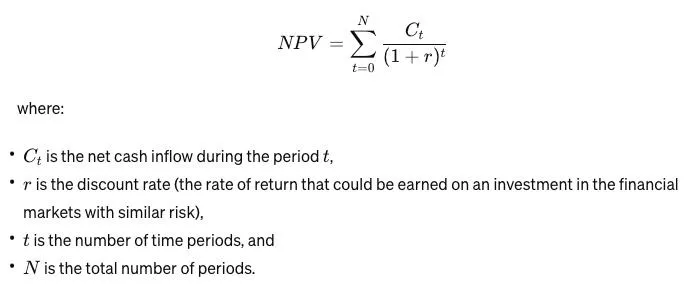

The formula to calculate NPV is:

Key Points:

Positive NPV: Indicates that the investment or project is expected to generate profit, considering the cost of capital. It suggests that the investment should potentially be made.

Negative NPV: Suggests that the project or investment's returns would not be sufficient to cover its costs and provide the minimum required return, indicating it might be best to reject the project.

NPV of Zero: Implies that the project's cash flows are exactly sufficient to repay the invested capital and provide the required rate of return, marking the investment as marginally acceptable.

Business Concept 3:

Internal Rate of Return (IRR)

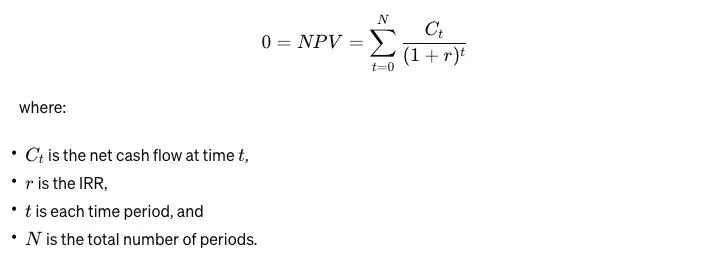

Internal Rate of Return (IRR) is a financial metric used to evaluate the profitability of potential investments or projects. It is the discount rate that makes the net present value (NPV) of all cash flows (both positive and negative) from a particular project or investment equal to zero.

In other words, the IRR is the annualized effective compounded return rate that can be earned on the invested capital, i.e., the yield on the investment.

The IRR is found by solving the equation for the discount rate (r) that makes the NPV of all cash flows equal to zero:

Part 2: Marketing Concepts

Business Concept 4:

Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) is a critical metric that estimates the total revenue a business can reasonably expect from a single customer account throughout the business relationship.

The focus is on the cumulative profit margin a customer generates for a company, not just on the initial purchase or a single transaction. This concept emphasizes the long-term value of customer relationships and encourages businesses to shift their focus from short-term transactions to long-term customer engagement and loyalty.

CLV can be calculated in a basic form using the following formula:

Average Purchase Value: This is calculated by dividing the total revenue by the number of purchases over a specific period.

Purchase Frequency: This represents how often an average customer makes a purchase within that time frame.

Average Customer Lifespan: This is an estimate of how long a customer continues to purchase from the business.

The product of the average purchase value and the purchase frequency gives the customer value per year, which, when multiplied by the average customer lifespan, provides the CLV.

Understanding and optimizing CLV can help businesses develop strategies to acquire new customers with a high potential value and retain profitable existing customers.

CLV is especially relevant in industries where repeat purchases are common. By focusing on increasing the CLV, companies can invest in customer satisfaction, loyalty programs, personalized marketing, and other strategies that contribute to a customer's long-term value.

Business Concept 5:

The 4 Ps (Product, Price, Place, Promotion) and Marketing Mix

The 4 Ps of marketing, also known as the marketing mix, are a foundational model in marketing used to consider the key factors that contribute to a brand's marketing strategy. These components help companies to effectively understand and communicate their product's value to their target customers.

The 4 Ps are:

Product: This refers to what the business is selling, which could be a physical good, services, experiences, or a combination of these. The product element involves creating something that meets the needs and desires of the target market. This includes the design, quality, features, branding, and any additional services or benefits that accompany the product.

Price: Price is what the customer pays for the product. It affects the company's profitability and therefore must be set carefully, considering the perceived value of the product, market demand, competition, and production costs. Pricing strategies can also include discounts, financing options, and leasing arrangements to make the product more appealing to specific market segments.

Place: Place, or distribution, involves the locations and methods used to make the product available to customers. This includes choosing the right distribution channels (like online, retail, wholesale, or direct to consumer) and logistics. The goal is to ensure that products are available in convenient locations in an appropriate manner and at the right times to meet customer demand.

Promotion: Promotion encompasses all the ways a business communicates about its product to the target market to stimulate interest and demand. This includes advertising, sales promotions, public relations, direct marketing, and personal selling. The promotional strategies are tailored to convey the product's benefits and differentiators to the target audience effectively, using the most suitable channels to reach them.

Business Concept 6:

Customer Segmentation

Customer segmentation, also known as market segmentation, is the process of dividing a company's customers into groups, or segments, that reflect similarities among customers in each group. The goal of customer segmentation is to identify high-yield segments to which marketing efforts can be targeted more effectively, optimizing resources and maximizing the impact of marketing strategies.

The main bases for segmenting a customer base include:

Demographic Segmentation: This involves dividing the market based on variables such as age, gender, family size, income, occupation, education, religion, ethnicity, and nationality. Demographic segmentation is one of the simplest and most widely used forms of segmentation because demographic information is relatively easy to obtain and often correlates with consumers' needs and interests.

Geographic Segmentation: Geographic segmentation divides customers based on their physical location, such as country, region, city, or neighborhood. This can be useful for businesses that need to tailor their products, services, or marketing efforts to local preferences, weather patterns, or regional differences in economic conditions.

Psychographic Segmentation: This type involves segmenting customers based on their lifestyle, personality traits, values, opinions, and interests. Psychographic segmentation can provide deep insights into customers' intrinsic needs and wants, enabling companies to develop highly targeted marketing strategies and product offerings.

Behavioral Segmentation: Behavioral segmentation divides customers based on their behavior related to the product, including usage rate, brand loyalty, benefits sought, purchase occasions, and response to a product. This type of segmentation is particularly useful for identifying loyal customers, understanding purchase patterns, and targeting promotional efforts to encourage a desired action.

Technographic Segmentation: With the rise of technology, segmenting customers based on their technology usage, preferences, and priorities has become increasingly relevant. This includes the types of devices they use, software preferences, and digital platforms they frequent.

Business Concept 7:

Customer Churn

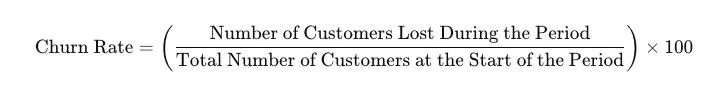

Customer churn, also known as customer attrition, refers to the loss of clients or customers who cease their relationship with a company over a specific period. In the context of a subscription-based service or any business that relies on repeat customers, churn represents the percentage of customers who do not renew their subscriptions, stop purchasing products, or discontinue their service usage.

Understanding churn is critical for businesses because acquiring new customers often costs significantly more than retaining existing ones.

High churn rates can indicate dissatisfaction with a product or service, ineffective customer relationship management, or stronger offerings from competitors.

Customer Churn Rate Formula:

Importance of Managing Customer Churn

Cost Efficiency: Reducing churn helps lower the costs associated with acquiring new customers, as retaining an existing customer is generally less expensive than acquiring a new one.

Revenue Growth: Lower churn rates contribute to a more stable and predictable revenue stream, which is crucial for the long-term sustainability and growth of the business.

Customer Lifetime Value (CLV): Minimizing churn rates maximizes the CLV, enhancing the overall profitability per customer.

Feedback Loop: Analyzing the reasons behind customer churn can provide valuable insights into areas for improvement, whether it’s customer service, product features, pricing, or user experience.

Part 3: Operations Management

Business Concept 8:

Supply Chain Management (SCM)

Supply Chain Management (SCM) is the comprehensive management of the flow of goods and services, involving the movement and storage of raw materials, of work-in-process inventory, and of finished goods from point of origin to point of consumption. It encompasses the planning and management of all activities involved in sourcing, procurement, conversion, and logistics management.

The 6 Components of SCM:

Procurement: The process of sourcing and acquiring the raw materials and components needed for product manufacturing or service delivery.

Production: The operations involved in converting raw materials into finished products, including manufacturing processes, quality control, and packaging.

Distribution: The logistics of transporting and distributing finished goods from manufacturing facilities to warehouses, retailers, or directly to customers.

Logistics: Involves the detailed coordination of complex operations involving many people, facilities, or supplies. It includes warehousing, transportation, inventory management, and order fulfillment.

Information Technology: Plays a crucial role in SCM by providing the tools for forecasting, process optimization, transaction facilitation, and information sharing among partners in the supply chain.

Integration: The strategic coordination of the supply chain for the purpose of integrating supply and demand management. This involves not just the company's internal functions but also the external partners like suppliers, distributors, and customers.

SCM is increasingly complex due to factors like globalization, market volatility, and the transition to e-commerce. SCM is focused on:

Cost Reduction: Efficient SCM can significantly reduce procurement, production, and distribution costs by optimizing operations and improving process efficiency.

Increased Efficiency: By optimizing supply chain processes, companies can streamline operations, reduce lead times, and improve product availability.

Customer Satisfaction: Effective SCM ensures that products are delivered to customers in a timely manner, improving customer service and satisfaction.

Competitive Advantage: A well-managed supply chain can provide a significant competitive advantage in terms of cost, quality, and delivery times.

Risk Management: Proper SCM helps in identifying, assessing, and mitigating risks in the supply chain, such as supplier failures, logistical errors, and market fluctuations.

Business Concept 9:

Demand Forecasting

Demand forecasting is the process of estimating the future demand for a company's products or services. This estimation is based on historical sales data, current market trends, and analysis of various external factors, such as economic indicators, market competition, and seasonal fluctuations.

Demand forecasting is a crucial component of supply chain management as it helps businesses make informed decisions regarding inventory levels, production planning, workforce management, and financial planning.

The main purposes of demand forecasting include:

Inventory Management: By accurately predicting demand, companies can maintain optimal inventory levels—enough to meet customer demand without overstocking, which ties up capital and increases storage costs.

Production Planning: Demand forecasting helps in planning the production schedule, including when to increase or decrease production, thereby optimizing production efficiency and reducing costs.

Workforce Management: It assists in determining the workforce requirements to meet production needs, helping in planning for hiring or training of employees.

Financial Planning: By estimating future sales, companies can forecast revenue and make informed budgeting decisions, including capital expenditures and marketing expenses.

Supply Chain Efficiency: Effective demand forecasting enhances the overall efficiency of the supply chain by improving the coordination and planning for procurement, manufacturing, and distribution activities.

Risk Management: It helps businesses prepare for and mitigate risks associated with demand fluctuations, ensuring that they can respond effectively to changes in the market.

Part 4: Business KPIs

Business Concept 10:

14 Most Important Domain-Specific Business KPIs

1. Financial KPIs:

Return on Investment (ROI): Measures the profitability of investments relative to their costs, highlighting the effectiveness of different investments.

Gross Profit Margin: Indicates the percentage of revenue that exceeds the cost of goods sold (COGS), revealing the financial health and pricing strategy effectiveness.

Operating Cash Flow: Provides insight into the cash generated from regular operating activities, indicating the company's ability to maintain and grow operations.

2. Customer-Related KPIs:

Customer Lifetime Value (CLV): Estimates the total revenue a company can expect from a single customer account, emphasizing the importance of customer retention.

Customer Acquisition Cost (CAC): Measures the total cost associated with acquiring a new customer, including marketing and sales expenses.

Net Promoter Score (NPS): Gauges customer satisfaction and loyalty by measuring the likelihood of customers to recommend a company's products or services to others.

3. Sales and Marketing KPIs:

Conversion Rate: Tracks the percentage of leads that convert to customers, assessing the effectiveness of sales and marketing strategies.

Cost Per Lead (CPL): Measures the cost-effectiveness of marketing campaigns in generating new leads.

Customer Churn Rate: Indicates the percentage of customers who stop using a company's products or services over a specific period, highlighting retention challenges.

4. Operational KPIs:

Inventory Turnover: Assesses how quickly inventory is sold or used over a given period, indicating the efficiency of inventory management.

Supply Chain Cycle Time: Measures the time taken for a product to move from procurement to sale, highlighting supply chain efficiency.

Employee Productivity: Quantifies the output produced per employee, indicating workforce efficiency.

5. Project Management KPIs:

Project Schedule Variance (SV): Measures the difference between the planned and actual project progress, indicating project management effectiveness.

Budget Variance: Compares the budgeted versus actual expenditure of projects, assessing financial management and forecasting accuracy.

Quick Recap: Top 10 Business Concepts

Today you learned the most important business concepts that all data scientists need to know.

Understanding these concepts will help you communicate more effectively with business leadership and understand their goals and objectives. By understanding their goals, you can more effectively make improvements with data science.

Now you have an idea of what the business cares about. But it won't help you much if you don't know where to start solving data science problems.

And I'll teach you how to fix that one next!

Mistake #3 is coming so go check your inbox now!

--Matt